Tax cuts a great opportunity for young professionals to start investing

There is no doubt cost of living pressures have made it tough for young professionals to achieve their saving and investment goals in recent times. From rising rent, food, petrol and energy prices, to increased HECS debts, there is simply less surplus cash to squirrel away, even for those earning good incomes.

Just another reason tax cuts will be so welcome by this cohort when they come into effect from 1 July 2024. Finally, some extra dollars in the pay packet each month that could go towards saving for a home loan deposit, or that dream car or overseas trip.

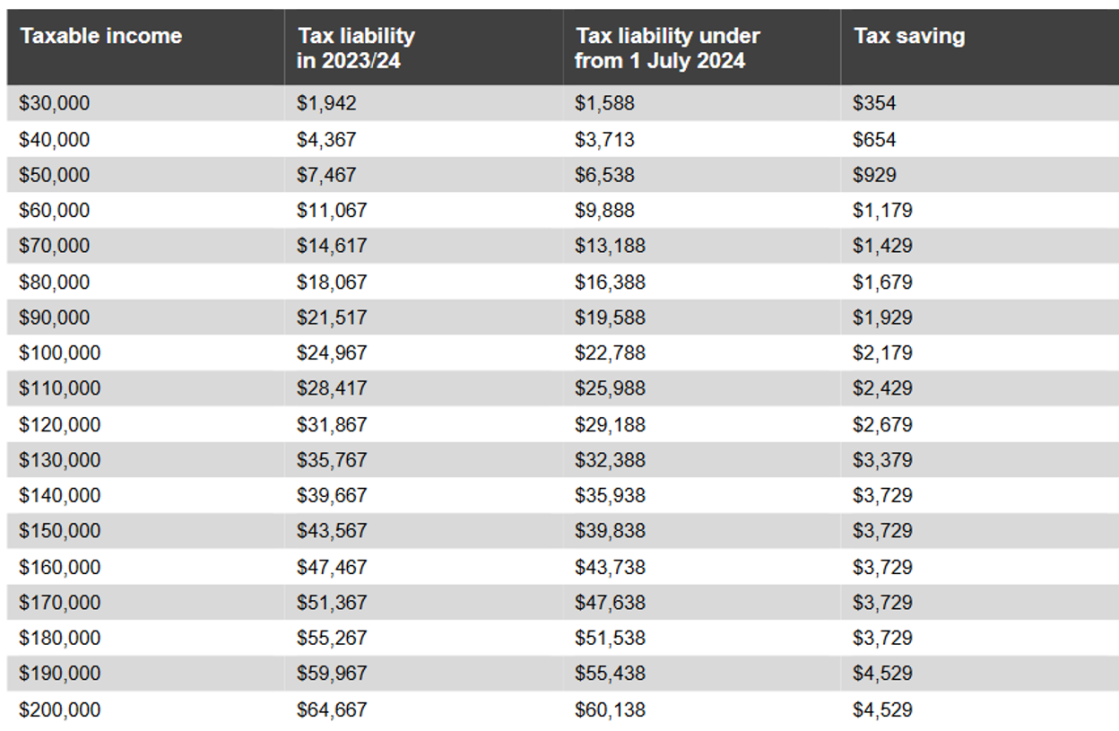

The below table shows how much different income earners will gain. The good news is young professionals earning up to $80,000 could see as much as $1,700 in tax cuts that could go towards savings and investments.

How much money could you free up?

The below chart shows the tax savings that can be expected at different taxable income levels.

Employers will automatically adjust the amount of tax withheld from those payments from 1 July 2024.

*Source: Australian Government Factsheet: Tax cuts to help Australians with cost of living.**Calculations include the Low Income Tax Offset and 2% Medicare Levy

Online investing with Rev Invest is supported by the FMD Investment Committee

Whether the young person in your life wants to travel, buy a house, or just enjoy the feeling of getting ahead faster, we all know they need to invest to build wealth.

Our online investment platform Rev Invest, is a convenient, affordable way to get started, with as little as a few thousand dollars.

Using an online investment platform backed by serious investment knowledge means young professionals can focus on what they do best, while their money grows, without having to regularly monitor markets and make trades themselves. Rev Invest offers a range of managed portfolios, so those new to investing can choose the level of risk that is right for them. The reason we can offer access to these diverse investment portfolios at a low and transparent fee, is because we invest in a range of ETFs, or Exchange Traded Funds.

ETFs level the playing field and make quality investment products available to more people with smaller amounts to invest, which is exactly what Rev Invest is all about. ETFs are often low cost, offer plenty of choice and are easy to liquidate if you need access to your money for life's next big adventure. But not all ETFs are made equal. The Rev Invest team, backed by FMD’s decades-strong investment capability, ensure only high-quality ETFs with long-term potential find their way into our portfolios.

This makes Rev Invest the perfect option for the smart beginner or anyone challenged for time, who would prefer to step out of having to make frequent decisions to manage their investment portfolio.

You can also invest in trust as a gift to a child or grandchild. It can be a great way to invest smaller inheritances when considering how to transfer intergenerational wealth.

Visit revinvest.com.au to find out more and see our latest portfolio performance or ask your FMD adviser about online investing.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.