Helping kids pay off their HECS debt to build wealth

Clients often ask us how they can help their kids build wealth faster and share ideas or strategies on becoming more financially savvy, earlier in life.

As well as sharing your own wealth building journey and encouraging them to get started with simple, reputable investment products, like FMD’s Rev Invest platform, there are other ways for contributing to your kids’ future, while keeping them accountable and invested long term.

Paying their student loan debt to free up cashflow for growth investments is one strategy worth considering.

How HECS/HELP debts work

The Australian government’s HECS/HELP system was designed to enable students to get the education they need for the career they want, by deferring fees until the student earns a reasonable professional salary.

This income-based repayment model means that once students cross a particular income threshold, a portion of their earnings automatically goes towards paying their HECS/HELP debts. While this is generally a fair system, the overall financial impact on young professionals depends on:

1. How much debt they have at the end of their study, i.e. more degrees or study time will mean more debt, and importantly,

2. How indexation will affect their repayments at the time they hit the repayment threshold.

HECS/HELP repayments have risen sharply

According to the ATO, the average HECS debt in 2021-22 was $24,771 and rising.

Unfortunately for young professionals paying HECS/HELP debt now, the CPI-based indexation applied to these loans has risen sharply from 1.8% in 2019 to 7.1% in 2023.

Naturally, more expensive HECS/HELP repayments make it harder for young professionals to find enough cash to invest in property, shares or superannuation for long-term wealth building.

How can parents or grandparents help?

One smart strategy we’ve worked on with several clients involves a parent or grandparent paying off their child's HECS debt as a lump-sum payment, with an agreement that the child salary-sacrifices an amount equivalent to the regular HECS repayment into superannuation.

The child’s personal cashflow remains the same but instead of making higher HECS repayments, they’re on their way to long term wealth building.

Here's an example of how the strategy works

For simplicity, let’s assume the child, with an average HECS balance of $24,771, pays 10% of the HECS debt as a salary sacrifice arrangement each year for 10 years.

Saving on future indexation

The lump-sum payment provides a 10-year saving by removing the indexation of the debt each year. This indexation will vary each year as it is based on the inflation rate, but the last indexation rate in June 2023 was a whopping 7.1%.

Reducing tax

In addition, the salary sacrifice arrangement reduces the child's income tax by approximately $372 each year as the salary-sacrificed super contributions come from gross salary, thereby reducing their taxable income.

Building wealth

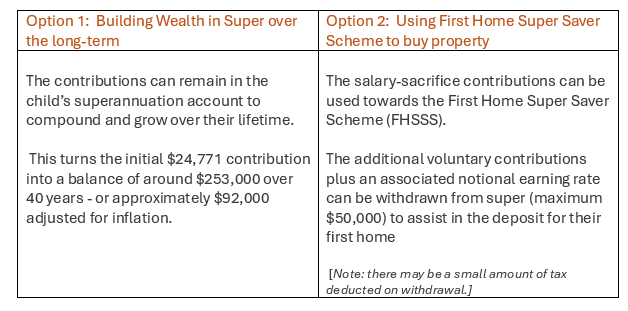

The contributions made into superannuation will be able to be invested into growth-type assets and there are two key options available.

Depending on their financial goals, option two may be more appealing to the child, as the extra contributions they make can be used for a tangible goal sooner, instead of for retirement in 40 years. This option will help them get a foot on the property ladder earlier, but they won't benefit from the compounding investment earnings within their super account over time.

Whether this strategy is a good idea for you and your family depends on your personal circumstances, so please speak with your FMD adviser if you’re interested in learning more.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.