Economic Snapshot: Markets react positively to Chinese stimulus

September saw two key policy highlights, one expected, the other unexpected.

Firstly, the US Federal Reserve agreed to finally begin their rate-cutting cycle, moving ahead with a 50-basis point (0.5%) reduction in the Fed Funds rate. The Chinese authorities also announced long-awaited stimulus measures to prop-up economic activity, largely in the property markets, while aiming to improve consumer and business confidence.

On the domestic front, Reserve Bank of Australian (RBA) Governor Michele Bullock indicated that interest rate cuts are unlikely "in the near term", as the central bank waits for more definitive signs that inflation is trending lower. The RBA again agreed to keep the cash rate steady at 4.35%, a level unchanged since November 2023.

The Australian dollar benefited from expectations of an aggressive easing cycle by the US Federal Reserve, reducing the difference between the Australian and US cash interest rates. These all influenced global equities in the period, which delivered a return of -0.5% for the month in AUD terms, although they gained 2.3% over the quarter.

At the same time, the Australian equity market outperformed its global counterparts during the September quarter, thanks to a surge in mining stocks following China’s stimulus package. This helped Australian shares rise by 7.8% for the quarter, bringing the year-to-date gain to 12.3%.

In bond markets, the US 10-year bond yield, which had rallied (yield has fallen) from 4.44% in early July to a low of 3.5% in September, ended the quarter at 3.81%. Australian bond yields followed a similar trend, starting the quarter close to 4.4%, dipping to 3.8%, and finishing the month at 4%.

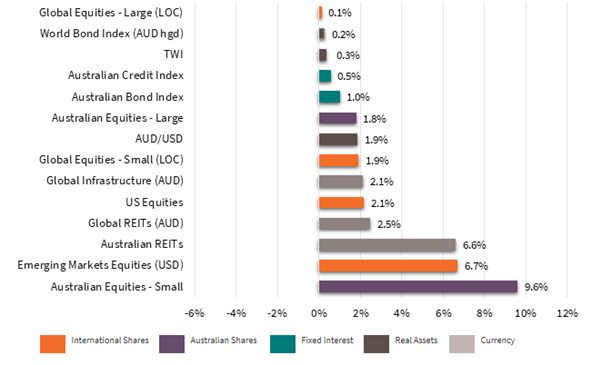

Asset Class Returns - September 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 127, September 2024

Global Developed Equities

Global equity markets rose in the month due to lower inflation, steady economic growth, and hopes for further interest rate cuts. The MSCI World ex-Australia index increased by 1.8% in USD for the month, 6.3% for the quarter, and 19% year-to-date. However, returns in AUD were -0.5% for the month and +2.3% for the quarter, as the Australian dollar benefitted from expectations of US rate cuts.

Weak US labour data and further progress with easing inflation led markets to expect a Fed rate cut, which ultimately came at 50 basis points. US bond yields reduced to 3.5%

In other geographies, Japan’s equity market recovered 5.7% for the quarter after initial drops, and the UK gained 8%. Meanwhile, China’s stimulus measures, including rate cuts and lending boosts, lifted its stock market by 24%, driving a 17.1% rise in Hong Kong and supporting global materials and resources stocks.

Later in September, oil prices rose due to escalating Middle East tensions. And while interest rates were generally lower, bond yields eventually pushed back over 4% at the end of the month as economic data remained buoyant.

Australian Equities

In the September quarter, the Australian equity market outperformed global equities, rising 7.8%, driven largely by a surge in mining stocks following China’s stimulus package. Year-to-date, the domestic market is up 12.3%. Banks gained 8.5% for the quarter, and miners climbed 10.8%.

Inflation data showed improvement in August, with annual inflation falling to 2.7%, helped by government energy subsidies. This led to market expectations of up to 100 basis points (1%) in rate cuts by the RBA, likely starting in early 2025.

Despite GDP growth of just 1% over the year and six consecutive quarters of declining per capita growth, employment remained strong, adding 47,500 jobs in August. Tax cuts and job resilience should provide economic support ahead of potential rate cuts, but does continue to risk pushing out the timing of when the RBA begins to take action.

RBA Governor Michele Bullock stated that interest rate cuts aren’t expected in the near term, with the cash rate staying at 4.35%. The RBA remains focused on bringing inflation back to its 2-3% target and may raise rates if needed. The Australian equity market earnings growth outlook remains challenged, with stretched valuations in the banking sector and modest earnings growth expected there and in other key industry groups.

Emerging Markets

Emerging markets saw their best quarterly return since late 2022, driven by China’s late-September stimulus measures. In USD terms, emerging markets rose 6.7% in the month, 8.7% for the quarter, and 16.9% year-to-date. In AUD terms, the index was up 4.7% for the quarter and 14.9% year-to-date.

China's stimulus package included a 50-basis point (0.5%) cut to the bank reserve requirement ratio, interest rate reductions, lower mortgage rates, and a 15% minimum housing down-payment. Additionally, 500 billion yuan was allocated for stock purchases, and 300 billion yuan in loans were made available for buybacks.

The measures boosted Chinese equities by nearly 24% in September. Emerging Asia also rose 9.5% for the quarter, with India up 7.3%. However, Latin America remained flat for the month and underperformed year-to-date. Although only a minor fiscal stimulus was announced, markets are seeking more soon.

Property and Infrastructure

REITs and listed infrastructure rallied due to falling bond yields. In Australia, nominal bond yields dropped nearly 40 basis points, while US yields fell over 60 basis points, benefiting bond proxies.

AREITs rose 6.6% in September, gaining 14.5% for the quarter and 26.1% year-to-date, making them one of the best-performing asset classes. Goodman Group led the way with a 40% rise, while Scentre Group and others, including Vicinity and Dexus, also showed improvement.

Global REITs (GREITs) recovered, rising 13.5% for the quarter after struggling with valuation issues earlier in the year. Global listed infrastructure increased 2.1% in September, with an 11.8% quarterly gain, driven by the cash rate and bond yield changes in the US.

Fixed Interest – Global

Bond markets focused on weakening US labour market data and expectations of aggressive Fed rate cuts during the quarter. In August, the US added 142,000 jobs, below expectations, and unemployment fell slightly to 4.2%. Inflation improved, dropping to 2.5%, leading the Fed to cut rates by 50 basis points, signalling the start of an easing cycle aimed at achieving a soft landing.

Weaker labour data and recession risks led markets to predict the Fed funds rate would drop to 2.9% within a year. However, stronger-than-expected September payrolls and services data led to a repricing of expectations. Two cuts were expected by year-end, with additional cuts by mid-2025 priced in by futures markets. US 10-year bond yields fell to 3.5% in September but ended the quarter at 3.81%.

In Europe, the ECB cut rates by 25 basis points amid weak growth indicators, while Japan's central bank kept its rate steady after a small hike in July. Global bonds returned 1.1% in September, while credit spreads narrowed.

Fixed Interest – Australia

Australian bond yields dropped from 4.4% to a low of 3.8% during the quarter before ending September at 4%. This decline reflected lower US bond yields, improved inflation data, and subdued GDP growth. GDP growth for the year was just 1%, the weakest in years, but the labour market remained strong, adding 47,500 jobs in August, with unemployment steady at 4.2%.

Inflation dropped from 3.5% in July to 2.7% in August, helped by government energy rebates, while core inflation continued to fall. The RBA kept the cash rate at 4.35%, emphasising the need for restrictive policy to bring inflation back to target. Markets expect the first rate cut in early 2025, with a total of 100 basis points in easing over the next year. The Bloomberg Composite index returned 1% for September and 3% for the quarter.

Commodities

Commodity markets had mixed performance in September and the quarter. Brent crude oil dropped 9% in September and 17% for the quarter due to weak Chinese demand, though recent tensions in the Middle East and Chinese policy measures pushed prices up to $77 per barrel. Iron ore fell to $90 per tonne before Chinese stimulus lifted it to $113 by early October.

Copper rose 6% in September but was up just 3.7% for the quarter. Gold, benefiting from geopolitical risks and central bank buying, gained 5.2% in September and is up 27% year to date.

Currencies

Interest rate differentials and Chinese stimulus influenced AUD movements in the period. The AUD reached 69 cents against the USD as markets anticipated aggressive Fed rate cuts, while the RBA outlook was less dovish.

In late September, China announced easing measures to support its 5% growth target, pushing iron ore prices up to $113 per tonne. Despite this, the AUD fell to 67 cents in early October due to Middle East tensions and positive US economic data. The USD dropped 1% in September but gained 2% in early October.

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.