Economic Snapshot: Markets hit turbulence

After a relatively optimistic start to the year, markets hit turbulence in March as global uncertainty returned to the spotlight. Trade tensions, inflation surprises, and signs of a slowdown challenged investor confidence, shifting expectations across markets and asset classes.

With inflation slowly coming under control and tariff threats looming, markets shifted their focus to what central banks might do next. In Australia, this meant pricing-in a faster pace of rate cuts by the RBA, at least four over the next year are in the markets projections.

However, investor sentiment was weighed down by growing uncertainty around US trade and foreign policy, the absence of the so-called “Trump put,” and fears of a global recession. This negative backdrop saw global equities fall 4.7% in March (in AUD terms), dragging quarterly returns to -2.4%.

Australia’s share market underperformed global peers, falling 3.4% in March to close the quarter down 2.8%. Defensive sectors like Utilities, Insurance, and Consumer Staples held up best, while Banks, REITs, Healthcare, and Diversified Financials saw larger declines.

Bonds provided some offset to equity weakness, with global bonds returning 1.1% for the March quarter (3.7% over 12 months) and Australian bonds rising 1.3% for the quarter (3.2% for the year).

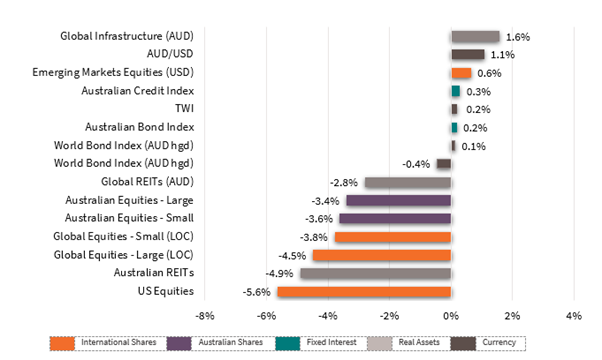

Chart 1: Asset Class Returns - March 2025

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 133, March 2025

Global Developed Equities

Global markets faced renewed pressure in March due to rising recession risks, tough US trade policies, and the absence of the “Trump put” (a belief the government would step in to support markets).

The MSCI ex-Australia Index fell 4.5% for the month and ended the quarter down 1.8%. US tariffs were extended to more countries and sectors, contributing to investor uncertainty. Economic indicators like consumer confidence and GDP forecasts began to weaken.

At the same time, inflation surprised on the upside. The Fed’s preferred measure hit 2.8% annually, prompting the Fed to hold interest rates steady, while markets began anticipating rate cuts in 2025. Bond yields fell in response.

The optimism that had surrounded AI-related tech stocks began to fade, giving way to more caution as competition intensified, and economic signals weakened. Investors looked for safety, and the more stable sectors took the lead.

In contrast, Europe – especially Germany – ramped up fiscal spending, which helped drive strong performance in European stocks.

Sector-wise, defensive areas like Energy, Insurance, Utilities, and Healthcare outperformed. In contrast, Technology and Consumer Discretionary lagged. Value stocks rose 4.8%, while Growth stocks fell 7.8%, reflecting a broader shift in investor preference, out of companies with more expensive valuation metrics and into companies with more attractive valuations.

Australian Equities

The Australian share market had a tough March, falling 3.4% and ending the quarter down 2.8%. Even with some encouraging domestic news—like slowing inflation, a bounce in retail spending, and supportive government policy—investors remained wary, keeping a close eye on global trade tensions and economic growth.

Defensive sectors like Utilities, Insurance, and Consumer Staples held up best, while more cyclical sectors struggled. Banks fell 2.1%, REITs dropped 6.8%, Healthcare 9%, and Diversified Financials 11.1%.

Inflation data showed core CPI easing to 2.7% in February, within the RBA’s target. Business and consumer confidence improved, and house prices edged up following the rate cut. Although employment dipped in February, the labour market remains relatively strong, with unemployment at 4.1%.

The 2025–26 Federal Budget was mildly expansionary, reflecting the upcoming May 3 election. It included modest tax cuts and extended cost-of-living relief, despite a weaker fiscal position due to $35 billion in new spending.

While Australia was spared the harshest US tariffs, the economy remains vulnerable to slower global trade.This has pushed bond yields lower, the AUD below 60 cents, and markets are now pricing in multiple rate cuts over the next year.

While some parts of the economy are showing resilience, sentiment remains fragile, and markets are likely to stay sensitive to global developments.

Emerging Markets

Emerging markets outperformed developed markets in the March quarter, rising 2.9% in USD terms. India, Brazil, and China led the gains, helped by a weaker US dollar and signs of stabilisation in China.

China’s market rose 15% for the quarter and is up 40% over the year, driven by improving growth, supportive policies, and optimism around AI. However, sentiment turned in early April as the US imposed steep tariffs—54% on China, 25% on India and South Korea, and higher for others.

Looking ahead, tariffs and the global economic cycle will be key drivers for emerging market performance.

Emerging markets have shown they can still shine in tough environments, especially when supported by domestic policy and growth. But with US tariffs targeting key economies like China and India, the road ahead is likely to be uneven.

Property and Infrastructure

Australian listed property (AREITs) fell sharply in the March quarter, driven by a steep decline in Goodman Group, down over 30% from its peak. Other property stocks saw modest gains.

Global REITs (GREITs) dropped 2.8% in March but still rose 0.7% for the quarter, outperforming broader markets. Global Infrastructure performed strongly, gaining 1.6% in March and 4.1% for the quarter, supported by falling real yields and higher inflation expectations.

The sharp fall in AREITs—particularly Goodman Group—highlights how quickly sentiment can turn in property markets. On the other hand, infrastructure continued to offer a more stable footing for investors, especially as inflation expectations remained elevated.

Fixed Interest – Global

Early optimism around Trump-era policies faded quickly, replaced by concern over a wave of new tariffs that unsettled global markets. Bond yields bounced around as investors tried to weigh rising inflation against the risk of economic stagnation.

US inflation surprised on the upside, with core PCE (personal consumption expenditures) rising to 2.8% annually. Meanwhile, GDP estimates fell sharply, raising concerns about stagflation and weakening the traditional role of bonds as a hedge against equities.

The US labour market remained strong, with job growth beating expectations and participation edging higher. However, consumer confidence dropped significantly, while short-term inflation expectations rose.

In Europe, German bond yields rose on the back of increased government spending. Germany’s manufacturing and consumer sentiment improved, though new US tariffs on EU cars and broader imports could slow recovery.

Global bonds returned 1.1% for the quarter, with Investment Grade and High Yield bonds delivering strong 12-month returns despite a weak March.

Central banks in Europe and the UK are expected to cut rates later in the year to support growth.

Fixed Interest – Australia

The RBA cut interest rates in February, joining other global central banks, as inflation eased.

Core inflation dropped slightly to 2.7%, just above the midpoint of the RBA’s target. Employment fell by 52,800, mainly due to a lower participation rate, though unemployment held steady at 4.1%.

Business conditions remained soft, but forward orders have been improving. While business confidence is still below average, consumer confidence rose in March despite global uncertainties.

With inflation moderating and tariff concerns rising, markets now expect at least four more RBA rate cuts over the next year.

The Bloomberg Composite Index for fixed interest investments rose 1.3% for the quarter and 3.2% over 12 months.

Commodities and Currencies

Gold surged past US$3,000 an ounce in March, peaking at US$3,133 after the US announced sweeping tariffs.

It later pulled back, likely due to hedge fund selling and a stronger USD. Still, gold rose 9.3% for the month and 19% for the quarter.

Gold’s strong performance reflected its traditional role as a safe haven during times of uncertainty—particularly when equity markets wobble and inflation fears return.

Other commodities also performed well. Copper, often seen as a gauge of economic activity, rose 11% over the quarter but fell in early April. Oil climbed to nearly US$75 by March’s end but dropped to US$64 amid recession fears and news of increased OPEC supply. Iron ore slipped over 4% in March to US$102.50 a tonne.

The US dollar weakened through the March quarter as markets factored in recession risks and likely Fed rate cuts. Softer economic data and tariff uncertainty weighed on sentiment.

In contrast, Europe responded to geopolitical tensions with increased defence and infrastructure spending, boosting equities, lifting bond yields, and strengthening the euro, which rose 4.5% to hit 1.10 USD.

Japan’s yen also gained, supported by rising wages and inflation, with more rate hikes expected. The Australian dollar edged up to 62.5 US cents by quarter-end but fell below 60 cents in early April as volatility spiked and the USD regained strength.

Currency markets are also reflecting this uncertainty, with the Aussie dollar falling below 60 cents in April for the first time since the pandemic, reminding investors just how sensitive our economy is to global shocks.

Key takeaways for investors

- Volatility returned: Global share markets fell as trade tensions, inflation surprises, and recession fears unsettled investors.

- Australia lagged: The local market underperformed global peers, with defensive sectors holding up best.

- Rate cuts expected: With inflation easing, markets are pricing in multiple RBA rate cuts over the next year—positive news for borrowers.

- Bonds and infrastructure provided stability: These asset classes helped cushion portfolio returns amid equity market weakness.

- Gold and commodities rallied: Safe-haven demand lifted gold, while copper and oil saw gains—though early April brought some pullback.

- Emerging markets outperformed: Driven by strong gains in China, India, and Brazil, but new tariffs could impact future performance.

- Australian dollar under pressure: It briefly fell below 60 US cents as global uncertainty picked up

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.