Economic Snapshot: Inflation tracks lower

In August, the market was supported by encouraging inflation data for July. Thanks to government energy measures, power costs came down, helping to lower annual inflation from 3.8% to 3.5%.

This improvement led markets to factor in the potential for up to 100 basis points of rate cuts by the Reserve Bank of Australia (RBA) over the next year, likely starting in early 2025.

Meanwhile, the Australian dollar strengthened against a weakening US dollar. As a result, global equity markets in AUD saw a modest increase of 0.1% for the month, while the hedged version performed better, rising by 2.9%.

In contrast, Australian equities underperformed their global counterparts in August, gaining just 0.5%, which brought the year-to-date return to 9.1%. During this time, US 10-year bond yields dropped from 4.0% to 3.8% after the release of payroll data, before climbing back to 3.9% by the end of the month. Australian bond yields also fell, moving from 4.12% to 3.97%, with the Bloomberg Composite index posting a modest gain of 1.4%.

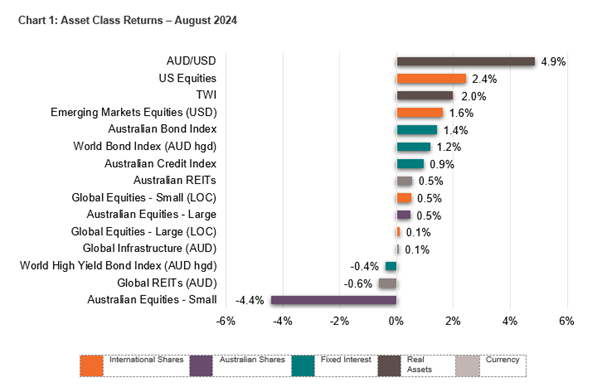

Asset Class Returns - August 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 126, August 2024

Global Developed Equities

Global equity markets rose by 2.6% in August, bringing the year-to-date return to 16.9% in USD terms. However, with the Australian dollar strengthening, the MSCI World ex-Australia index in AUD gained just 0.1%, while the hedged version was up 2.9%.

Early in the month, markets experienced a sharp drop due to weak US labour data, with the S&P 500 falling 6% before rallying to near-record highs later in the month. Japan’s TOPIX index was close to the epicentre of the abrupt market fall, plunging 21% following an unexpected interest rate hike. By the end of the month, the majority of the losses had been recovered.

The market rebound was driven by more positive views on the US economy, inflation showing further signs of slowing, and comments from the Federal Reserve hinting at potential rate cuts in September.

Defensive sectors like real estate (REITs), utilities, healthcare, and consumer staples outperformed, while mega-cap tech stocks lagged. Despite strong overall performance, some uncertainty remains, with markets pricing in potential US rate cuts and the upcoming US election adding to the caution.

Australian Equities

The Australian equity market rose by 0.5% in August, bringing the year-to-date gain to 9.1%, but it lagged global markets. While the banking sector continued to perform well, miners and energy stocks fell sharply, and the small-cap index dropped 4.4%.

July inflation data provided some relief, with government measures lowering power costs and reducing annual inflation from 3.8% to 3.5%. This improvement led markets to price in up to 100 basis points (or 1.0%) of potential RBA rate cuts, likely starting in early 2025. Recent tax cuts, equivalent to 1.5% of income, may support the economy, though much of the benefit is expected to go toward replenishing savings.

Company earnings season exceeded expectations, with cost controls and pricing power helping protect company profit margins despite weaker demand. However, overall earnings were down more than 4%, with the resources, banks, and REIT sectors underperforming, while industrials saw growth. The earnings outlook remains subdued, with only about 5% growth expected for the 2025 financial year.

Bank stocks are now trading at high (price/earnings) multiples, with dividend yields falling below cash and bond rates. Meanwhile, the struggling Chinese property sector continues to weigh on the resources sector, especially impacting on iron ore and Australian producers.

Emerging Markets

Emerging markets rose 1.6% in USD terms in August, bringing the year-to-date gain to 9.6%. However, in AUD terms, the index fell 1.8% for the month but is still up 10.2% for the year.

Sentiment toward emerging markets is mixed. While China's economy remains weak, especially in housing and consumer sectors, India and ASEAN countries show stronger growth and inflation trends. Lower US interest rates have eased the pressure of a stronger USD, typically positive for emerging market economies.

In August, EM Asia rose 1.6%, with China up 1%, Korea down 2.2%, and Taiwan gaining 3.4%. Latin America saw strong performance, with Brazil up 6.7%, though Mexico and Turkey fell.

The prospect of significant Fed rate cuts and a weaker USD has shifted investor focus to higher-growth ASEAN markets, with MSCI EM ASEAN rising 9.7%. Countries like the Philippines, Indonesia, Malaysia, and Thailand saw gains of 9% or more. Malaysia has especially benefited from structural reforms and changes in global supply chains.

Meanwhile, China's economy continues to struggle, with real estate construction down over 60% from 2019 levels and weak manufacturing and services data pointing to further challenges.

Property and Infrastructure

REITs and listed infrastructure saw softer returns in August, despite growing optimism around central bank easing and lower bond yields.

Australian REITs (AREITs) rose 0.5%, with strong year-to-date gains of 18.3%, driven by stocks like Goodman Group. However, global REITs (GREITs), more exposed to the office sector, fell 0.6% in August, bringing their year-to-date rise to just 2.5%. Global listed infrastructure remained flat for the month but has gained 10.3% over the past six months, benefiting from lower real bond yields.

Fixed Interest – Global

August saw a spike in market volatility, driven by rising US unemployment (4.3%) and concerns of a recession. This led to a temporary sell-off in risk assets and a repricing in rates markets.

However, optimism returned with strong US retail sales and a dovish speech by Fed Chair Jay Powell, suggesting the economy was still on track for a "soft landing". US 10-year bond yields fell to 3.8% before climbing back to 3.9%. Inflation dropped to 2.9% in July, shifting the Fed’s focus to supporting employment. A September rate cut now seems likely, with markets expecting up to eight cuts by mid-2025.

Japan’s financial markets were shaken by the yen's strength, but reassurance from the Bank of Japan stabilised the equity market. In contrast, Eurozone disinflation stalled, with core inflation flat. Corporate credit spreads also stabilised, with high-yield spreads narrowing slightly, reflecting a more positive economic outlook.

Fixed Interest – Australia

In July, Australia’s unemployment rate rose to 4.2%, the highest since 2021, but job creation remained strong with 58,000 new jobs added. The participation rate hit a record 67.1%, keeping the labour market tight.

Headline inflation fell to 3.5%, down from 3.8% in June, and “trimmed mean” inflation dropped to 3.8%. Electricity prices fell 5.1% due to energy rebates.

Despite this, inflation remains high, and the RBA ruled out near-term rate cuts, although markets are pricing in 100 basis points of easing over the next year. Long term bond yields fell to 3.97%.

Commodities

Commodity markets weakened despite prospects of central bank easing and a weaker USD. Brent crude oil fell 2.4% to $78.82 per barrel, driven by weaker demand and OPEC+ plans to ease production cuts.

Copper rose 2.2%, while iron ore dropped 7% to $98 per tonne, down nearly a third this year. Gold was one of the few commodities to gain, rising 2.3% to $2,503.37, boosted by lower real yields, expectations of US rate cuts, and increased geopolitical risk, leading to a 21.4% rise this year.

Currencies

Currency markets were active in August. Weaker US employment data and declining inflation led to expectations of 200 basis points of Fed rate cuts over the next year, causing the USD to fall over 2% against the euro, pound, and yen. The yen, after rallying due to a surprise rate hike by the Bank of Japan, settled at 146 by month-end.

The AUD rose nearly 2%, reaching almost 68 cents against the USD, driven by narrowing interest rate differentials. However, concerns remain about the weakening Chinese economy and declining demand for Australian exports.

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.